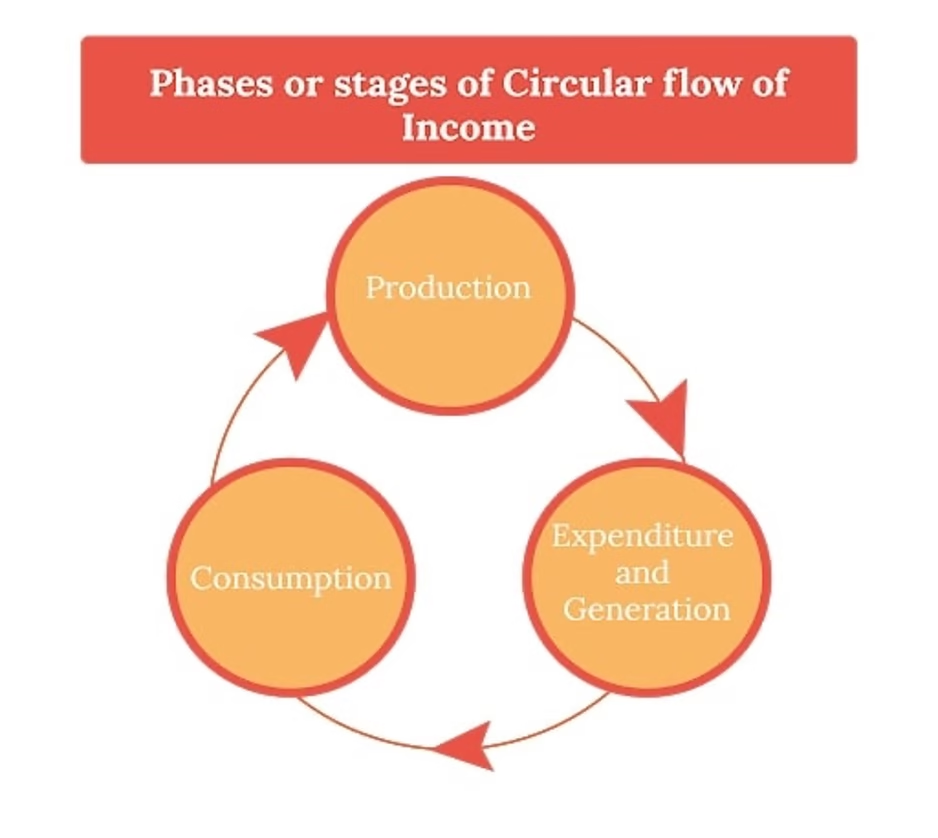

Circular flow of income refers to the continuous circulation of production, income generation and expenditure involving different sectors of the economy.

- Production phase, In this phase, firms produce goods and services with the help of factor services.

- Income phase, this phase involves the flow of factor income (rent, wages, interest and profits) from firms to the households, who owns the means of production.

- Expenditure phase, In this phase, the income received by factors of production, is spent on the goods and services produced by firms.

Income is first generated by production units, then distributed to households and finally spent on goods and services produced by these units to make the circular flow complete its course.

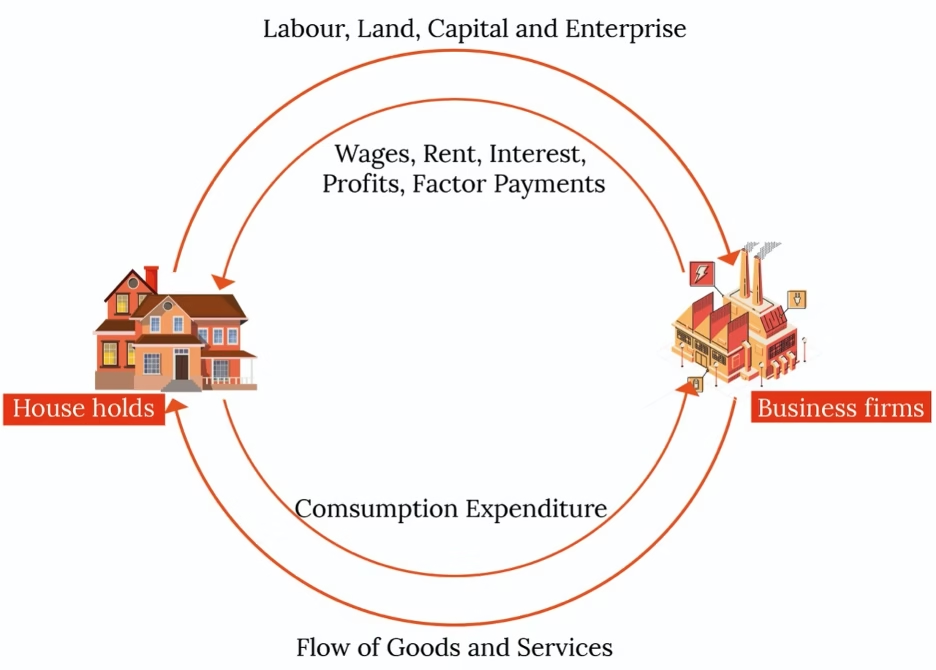

Circular Flow of Income: Two – Sector Economy

The circular flow model in the two-sector economy is a hypothetical concept which states that there are only two sectors in the economy, household sector and business sector (business firms).

- The household sector is the source of factors of production who earn by providing factor services to the business sector.

- The business sector refers to the firms that produce goods and services, and receive income by supplying the produced goods to the household sector.

The two sector economy has the following assumptions:

- There are only two sectors in the economy; household sector and business sector.

- No government interventions over the economic activities.

- Business sectors do not carry out any import or export activities, creating a closed economy.

In the lower part of the figure, money flows from households to firms as consumption expenditure made by the households on the goods and services produced by the firms, while the flow of goods and services is in opposite direction from business firms to households.

Thus we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus there is, in fact, a circular flow of money or income. This circular flow of money will continue indefinitely week by week and year by year.

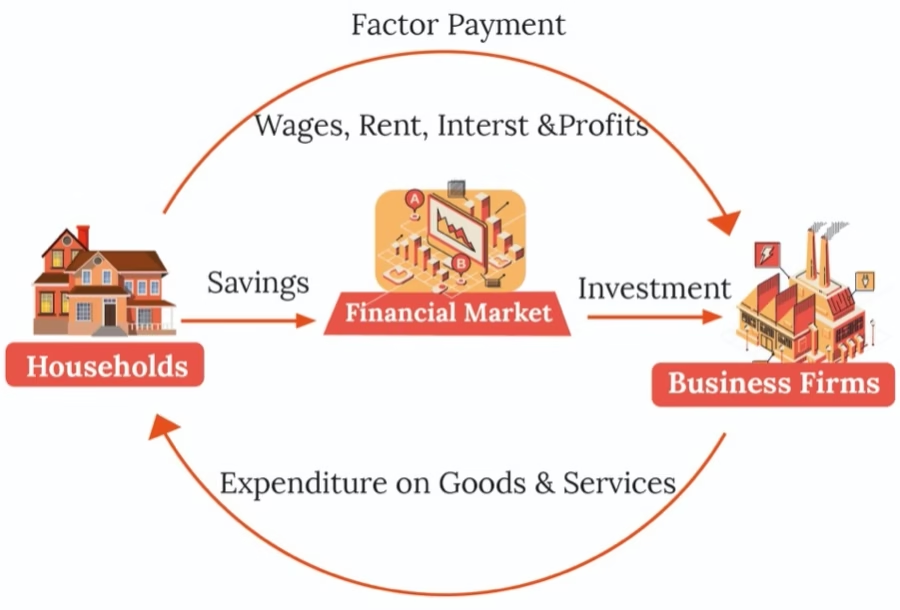

In our above analysis of the circular flow of income we have assumed that all income which the households receive, they spend it on consumer goods and services. As a result of circular flow of money, spending and income remains undiminished.

We will see what happens if the households save a part of their income, how their savings will affect money flows in the economy. When households save, their expenditure on goods and services will decline to that extent and as a result money flow to the business firms will contract. With reduced money receipts, firms will hire fewer workers (or lay off some workers) or reduce the factor payments they make to the suppliers of factors such as workers.

This will lead to the fall in total incomes of the households. Thus, savings reduce the flow of money expenditure to the business firms and will cause a fall in economy’s total income. Economists therefore call savings a leakage from the money expenditure flow. But savings by households need not lead to reduced aggregate spending and income if they find their way back into flow of expenditure.

In free market economies there exists a set of institutions such as banks, insurance companies, financial houses, stock markets where households deposit their savings. All these institutions together are called financial institutions or financial market. We assume that all the savings of households come in the financial market. We further assume that there are no inter-households borrowings.

It is business firms who borrow from the financial market for investment in capital goods such as machines, factories, tools and instruments, trucks. Firms spend on investment in order to expand their productive capacity in future.

Thus, through investment expenditure by borrowing the savings of the households deposited in financial market, are again brought into the expenditure stream and as a result total flow of spending does not decrease. Money flow of savings is shown from the households towards the financial market. Then flow of investment expenditure is shown as borrowing by business firms from the financial market.

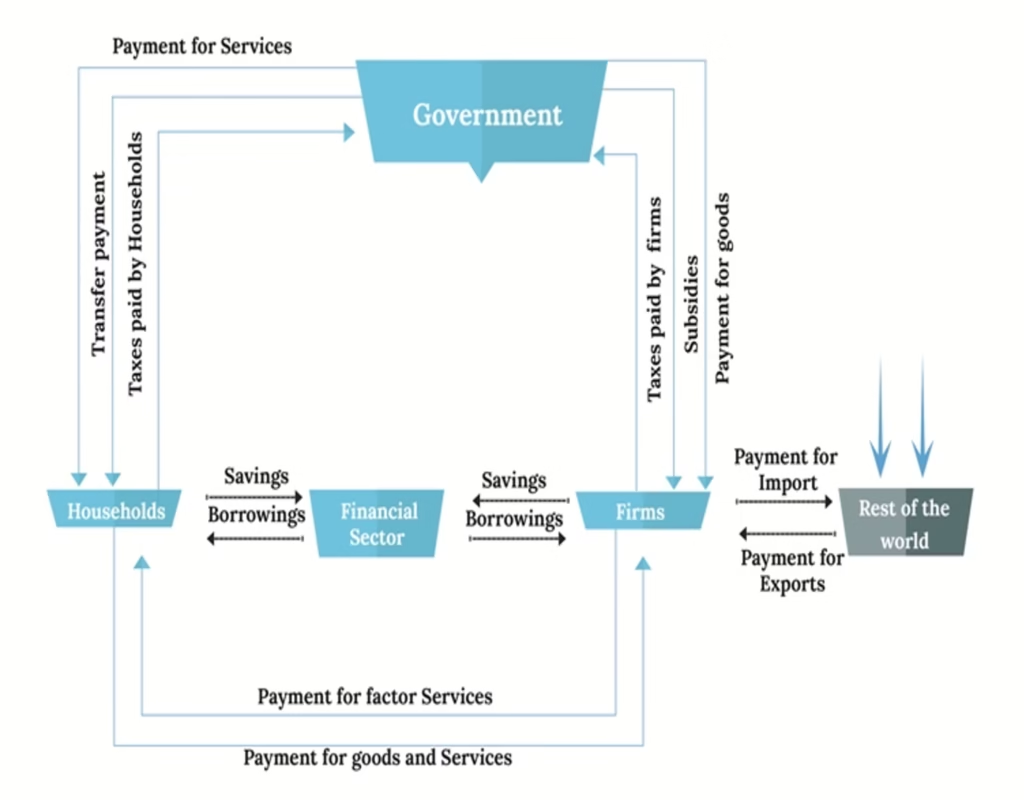

Circular Flow of Income: Four- Sector Economy

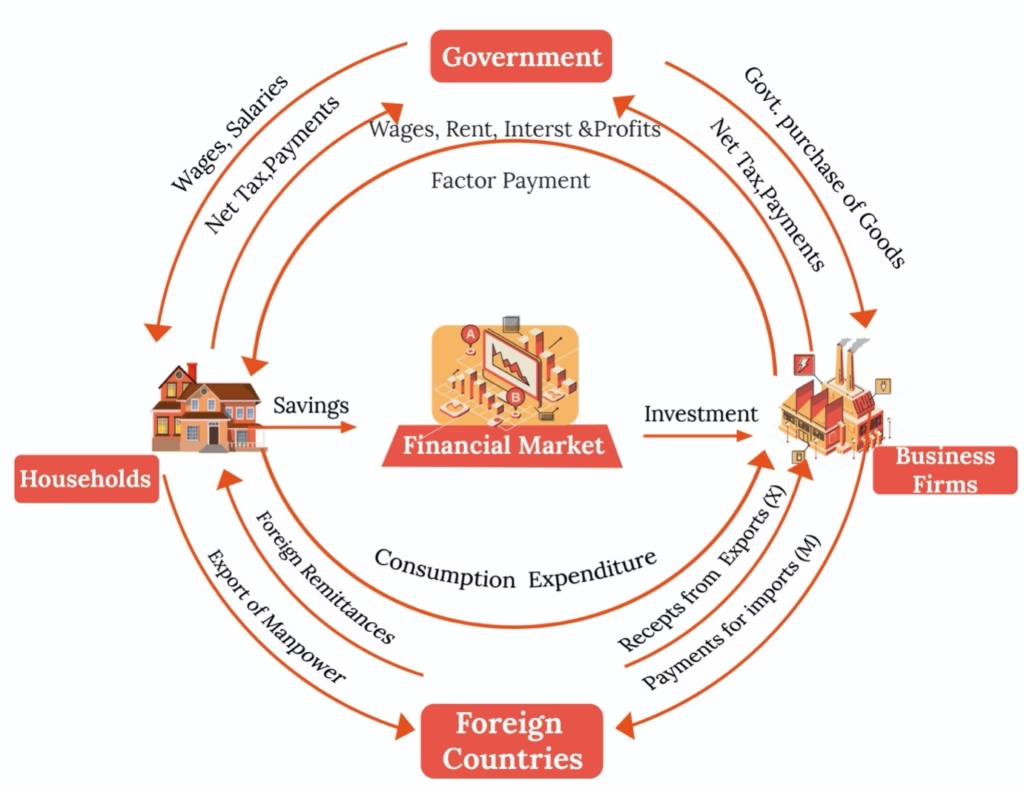

The circular flow model in four sector economy provides a realistic picture of the circular flow in an economy. Four sector model studies the circular flow in an open economy which comprises of the household sector, business/firms, government, and foreign sector.

Let’s try to understand the money flows that are generated in an open economy, that is, economy which have trade relations with foreign countries. Thus, the inclusion of the foreign sector will reveal to us the interaction of the domestic economy with foreign countries. Foreigners interact with the domestic firms and households through exports and imports of goods and services as well as through borrowing and lending operations through financial market.

Goods and services produced within the domestic territory which are sold to the foreigners are called exports. On the other hand, purchases of foreign-made goods and services by domestic households are called imports.

The additional money flows that occur in the open economy when exports and imports also exist in the economy. In our analysis, we assume it is only the business firms of the domestic economy that interact with foreign countries and therefore export and import goods and services.

If exports are equal to the imports, then there exists a balance of trade. Generally, exports and imports are not equal to each other. If value of exports exceeds the value of imports, trade surplus occurs. On the other hand if value of imports exceeds value of exports of a country, trade deficit occurs.

In the open economy there is interaction between countries not only through exports and imports of goods and services but also through borrowing and lending funds or what is also called financial market. These days financial markets around the world have become well integrated.

Go through the below diagrams to revise the circular flow of Income.