Monetary Policy is defined by the Reserve Bank of India as “the policy of the central bank with regard to the use of monetary instruments under its control to achieve the goals specified in the RBI Act, 1934.”

Monetary policy is concerned with the measures taken to regulate the supply of money, the cost and availability of credit in the economy there by determining the lending and borrowing rates of interest of the banks. In developed countries the monetary policy has been used for overcoming depression and inflation as an anti-cyclical policy.

However, in developing countries it has to play a significant role in promoting economic growth. It helps in Controlling the Supply of Money and Credit by the Central Bank by using various instruments of Monetary Policy.

Objectives of Monetary Policy

- Promote Growth and Stability of an Economy

- Maintain Price Stability/Control Inflation

- Maintain Exchange Rate Stability

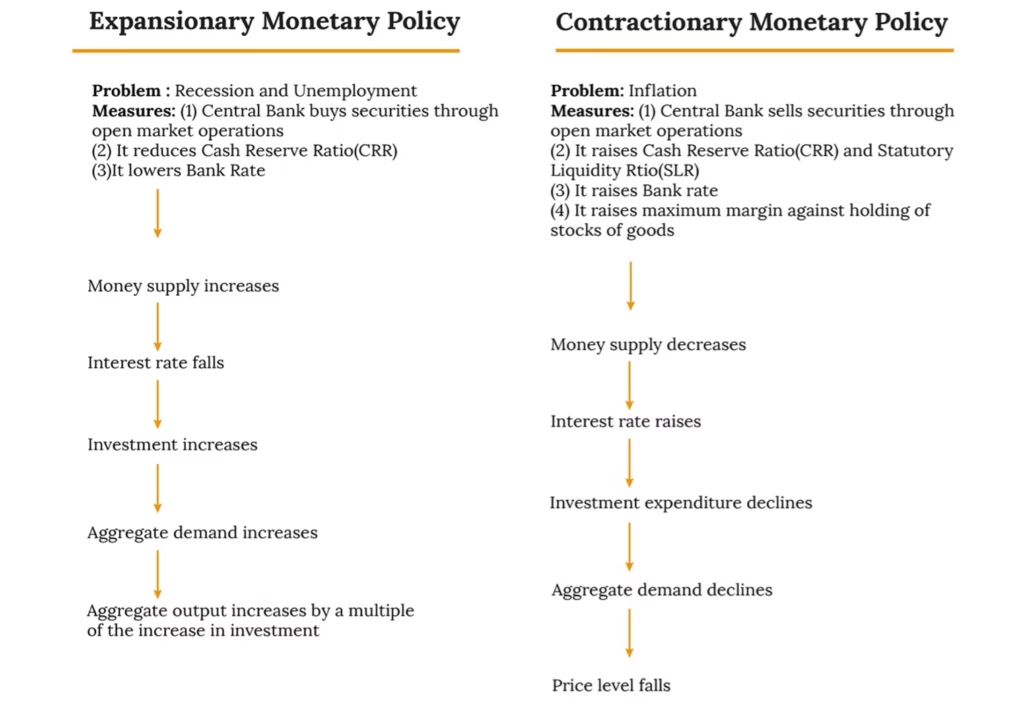

Expansionary Monetary Policy

- Expansionary monetary policy is when a central bank uses its tools to stimulate the economy. That increases the money supply, lowers interest rates and increases aggregate demand. That boosts growth as measured by gross domestic product. It usually diminishes the value of the currency, thereby decreasing the exchange rate. It is the opposite of contractionary monetary policy.

- A policy by monetary authorities to expand money supply and boost economic activity, mainly by keeping interest rates low to encourage borrowing by companies, individuals and banks. An expansionary monetary policy can involve quantitative easing, whereby central banks purchase assets from banks. This has the effect of lowering yields on bonds and creating cheaper borrowing for banks. This, in turn, boosts banks’ capacity to lend to individuals and businesses. An expansionary monetary policy also risks ramping up inflation.

- Expansionary monetary policy could also be termed a ‘loosening of monetary policy’. It is the opposite of ‘tight’ monetary policy.

Contractionary Monetary Policy

- A contractionary monetary policy is a macroeconomic strategy used by a central bank to decrease the supply of money in the market in an effort to control inflation. The money supply is controlled by adjusting interest rates, purchasing government securities on the open market, and adjusting government spending.

- A contractionary policy is used to decrease the money supply, by increasing interest rates to discourage borrowing and decreasing government spending to reduce the availability of money. This leads to higher interest rates, lower income, and a drop in demand, production, and employment.

The monetary authorities exercises a contractionary monetary policy only when it seeks to slow down inflation or depress an impending economic bubble. This forces banks to charge higher interest rates to anticipate the lower money supply, businesses contract their borrowing and cease expansion. This leads to higher unemployment and lower demand as consumer spending is depressed and the economy is tightened to the extent of recession.