The Reserve Bank of India is the central bank of the country. Central banks are a relatively recent innovation and most central banks, as we know them today, were established around the early twentieth century.

The Reserve Bank of India was set up on the basis of the recommendations of the Hilton Young Commission. The Reserve Bank of India Act, 1934 (II of 1934) provides the statutory basis of the functioning of the Bank, which commenced operations on April 1, 1935.

The Bank was constituted to

- Regulate the issue of banknotes

- Maintain reserves with a view to securing monetary stability and

- To operate the credit and currency system of the country to its advantage.

The Bank began its operations by taking over from the Government the functions so far being performed by the Controller of Currency and from the Imperial Bank of India, the management of Government accounts and public debt. The existing currency offices at Calcutta, Bombay, Madras, Rangoon, Karachi, Lahore and Cawnpore (Kanpur) became branches of the Issue Department. Offices of the Banking Department were established in Calcutta, Bombay, Madras, Delhi and Rangoon.

Burma (Myanmar) seceded from the Indian Union in 1937 but the Reserve Bank continued to act as the Central Bank for Burma till Japanese Occupation of Burma and later up to April, 1947. After the partition of India, the Reserve Bank served as the central bank of Pakistan up to June 1948 when the State Bank of Pakistan commenced operations. The Bank, which was originally set up as a shareholder’s bank, was nationalised in 1949.

An interesting feature of the Reserve Bank of India was that at its very inception, the Bank was seen as playing a special role in the context of development, especially Agriculture.

When India commenced its plan endeavours, the development role of the Bank came into focus, especially in the sixties when the Reserve Bank, in many ways, pioneered the concept and practise of using finance to catalyse development.

The Bank was also instrumental in institutional development and helped set up institutions like the Deposit Insurance and Credit Guarantee Corporation of India, the Unit Trust of India, the Industrial Development Bank of India, the National Bank of Agriculture and Rural Development, the Discount and Finance House of India etc. to build the financial infrastructure of the country.

With liberalisation, the Bank’s focus has shifted back to core central banking functions like Monetary Policy, Bank Supervision and Regulation, and Overseeing the Payments System and onto developing the financial markets.

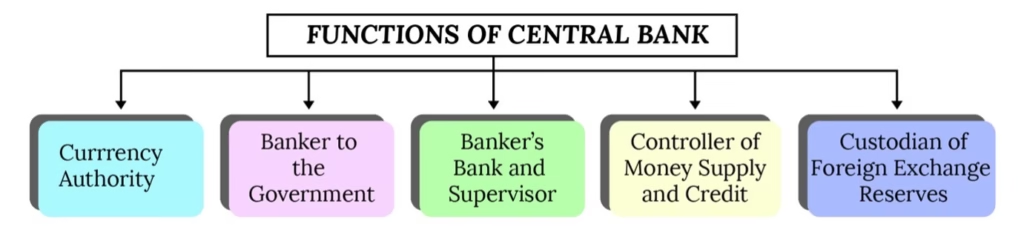

Bank of issuing or currency

The central bank of the country has the monopoly of issuing notes or paper currency to the public. Therefore, the central bank of the country exercises control over the supply of currency in the country. In India with the exception of one rupee notes which are issued by the Ministry of Finance of the Government of India, the entire note is done by the Reserve Bank of India.

Central banks have been following different methods of note issue in different countries. The central bank is required by law to keep a certain amount of gold and foreign securities against the issue of notes. In some countries, the amount of gold and foreign securities bears a fixed proportion, between 25 to 40 per cent of the total notes issued. In other countries, a minimum fixed amount of gold and foreign currencies is required to be kept against note issue by the central bank.

Seigniorage

Seigniorage is a fancy term for the profits governments make by minting currency. It is the difference between the face value of a currency note or coin, and its actual production cost. For instance, if the cost of printing a Rs. 2,000- note is about Rs.4, printing one such note and putting it into circulation fetches a profit of Rs. 1,996. Usually central banks ‘earn’ this profit and transfer it to the Government.

It is normal to assume that whenever government issues new currency, the RBI will pocket a profit. Higher denomination notes earn higher profits. However, things are different in the case of coins where the cost of minting can is usually equal to the face value, and can fluctuate based on the price of base metal.

Banker to the banks

The central bank acts as a banker to the commercial banks in the following manner:

- Custodian of the cash reserves of the commercial banks (CRR).

- Lender of the last resort in the sense that if commercial banks fail to generate enough cash from its own sources it approaches the central bank as a last resort. The central bank in turn may grant loans and advances to the needy banks.

- The central bank also acts as central clearing house for the commercial banks.

All other banks in the country are found by law to keep a fixed portion of their total deposits as reserves with the central bank. These reserves help the central bank to control the issue of credit by commercial banks. They in return can depend up on the central bank for support at the time of emergency.

This help may be in the form of a loan on the strength of approved securities or through rediscounting of bills of exchange. Thus the central bank is the lender of last resort for other banks in difficult times.

In India, scheduled banks have to keep deposits with the Reserve Bank not less than 5% of their current demand deposits and 2% of their fixed deposits as reserves. In return they enjoy the privilege of rediscounting their bills with the Reserve Bank as well as securing loans against approved securities when needed.

Clearing function is also performed by the central bank for the banks. Since banks keep cash reserves with the central bank, settlement between them may be easily effected by means of debts and credits in the books of the central bank. If clearing go heavily against some bank, its cash reserves with the central bank will fall below the prescribed limit and therefore the bank concerned will have to make up the deficiency.

Banker to the government

As a banker to the government the central bank carries out all banking businesses on behalf of both the central government and the state governments.

It maintains current account of the government for keeping cash balances and also making and receiving payments on behalf of the government. It provides loans and advances to the government. It also acts as financial advisor to the government.

Controller of credit and money supply

The chief objective of the central bank is to maintain price and economic stability. For controlling inflationary and deflationary pressures in the economy the central bank adopts quantitative and qualitative measures of credit control.

Quantitative methods aim at controlling the cost and quantity of credit by adopting bank rate policy, open market operations, and by variations in reserve ratios of commercial banks.

Qualitative methods control the use and direction of credit. These involve selective credit controls and direct action.

Custodian of the stock of gold and foreign exchange reserves of the nation

The central bank keeps and manages the foreign exchange reserves of the country. An important function of a central bank is to maintain the exchange rate of the national currency.

For example, the Reserve Bank of India has the responsibility of maintaining the exchange value of the rupee. When a country has adopted flexible exchange rate system under which value of a currency is determined by the demand for and supply of a currency, the value of a currency, that is, its exchange rate with other currencies is subject to large fluctuations which are harmful for the economy.

Under these circumstances, it is the duty of the central bank to prevent undue depreciation or appreciation of the national currency. Since 1991 when the rupee has been floated, the value of Indian rupee, that is, its exchange rate with US dollar and other foreign currencies has been left to be determined by market forces.

RBI has been taking several steps from time to time to stabilize the exchange rate of rupee, especially, in terms of US dollar. There are several ways by which RBI can manage or maintain the exchange rate of the rupee.

- If due to speculative activities of foreign exchange operators, the rupee starts depreciating fastly, RBI can intervene in the market. It can use its reserves of dollars and supply dollars in the market from its own reserves. With the increase in the supply of dollars, the rupee will be prevented from depreciation. It may however be noted that the success of this step depends on the amounts of dollar reserves with RBI.

- Another method by which RBI can manage the exchange rate of rupee is adopting measures which will reduce the demand for dollars. Some importers, foreign investors, foreign exchange operators try to avail of cheap credit facilities of banks and borrow rupee funds from the banks and try to convert them into dollars. This raises the demand for dollars and leads to the depreciation of the Indian rupee. Such a situation occurred in July-September, 1998. RBI intervened and raised the Cash Reserve Ratio (CRR) and increased its repurchase rates. This succeeded in mopping up the excess liquidity with the banks and reduced their lending capacity. This led to the reduction in the demand for dollars and helped in preventing the rupee from depreciating.