Reserve Ratio

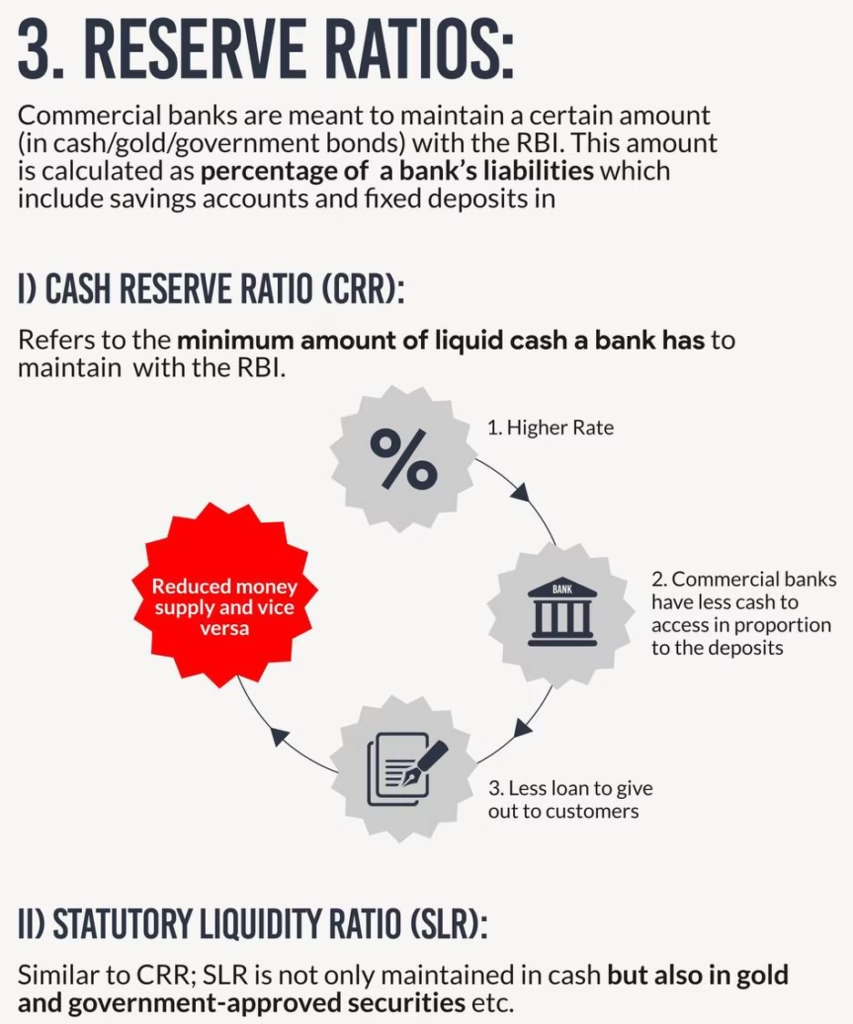

Reserve ratio (RR) is the proportion of the total deposits commercial banks keep as reserves. Banks hold a part of the money people keep in their bank deposits as reserve money and loan out the rest to various investment projects.

Reserve money consists of two things – vault cash in banks and deposits of commercial banks with RBI. Banks use this reserve to meet the demand for cash by account holders. Keeping reserves is costly for banks, as, otherwise, they could lend this balance to interest earning investment projects.

However, RBI requires commercial banks to keep reserves in order to ensure that banks have a safe cushion of assets to draw on when account holders want to be paid. RBI uses various policy instruments to bring forth a healthy RR in commercial banks.

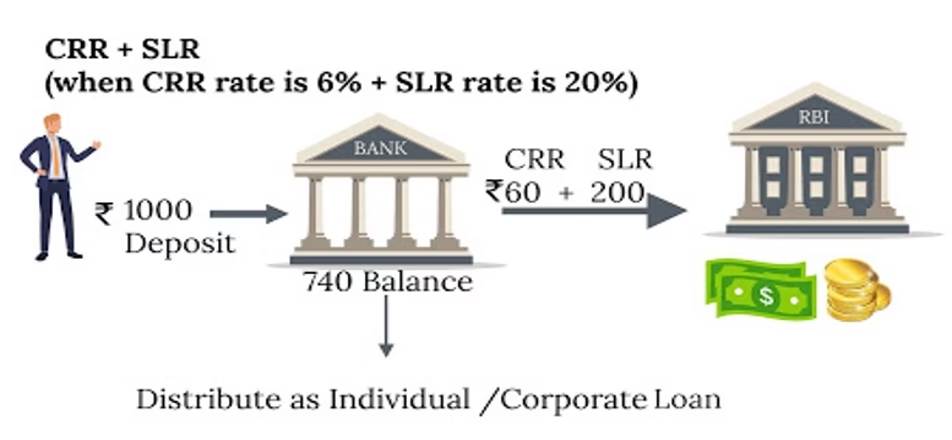

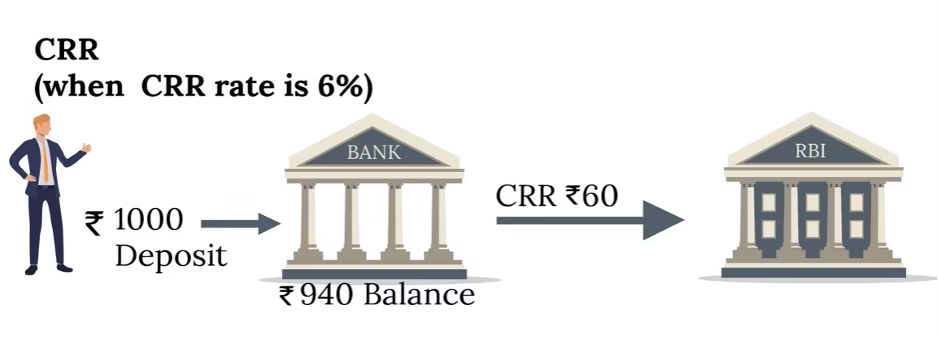

Cash Reserve Ratio

Cash Reserve Ratio is money that banks park with the RBI for free, without receiving any interest on it. The CRR, is calculated as a percentage of each bank’s net demand and time liabilities (NDTL).

What is Net Demand and Time Liability (NDTL)?

NDTL is sum of demand and time liabilities (deposits) of banks with public and other banks wherein assets with other banks is subtracted to get net liability of other banks.

- Deposits of banks are its liability and consist of demand and time deposits of public and other banks.

- Demand deposits include all liabilities which are payable on demand and includes current deposits, demand liabilities portion of savings bank deposits, demand drafts, balances in overdue fixed deposits etc.

- Time deposits are those which are not payable on demand and includes fixed deposits, staff security deposits, time liabilities portion of savings bank deposits etc.

- Banks also invest in demand and time deposits of other banks and certificate of deposits. Banks also borrow from other banks in call market etc. This represents banks liability to other banks.

- NDTL is calculated and reported every fortnight Friday by banks.

- NDTL is used by banks for computation of CRR, SLR and now LAF.

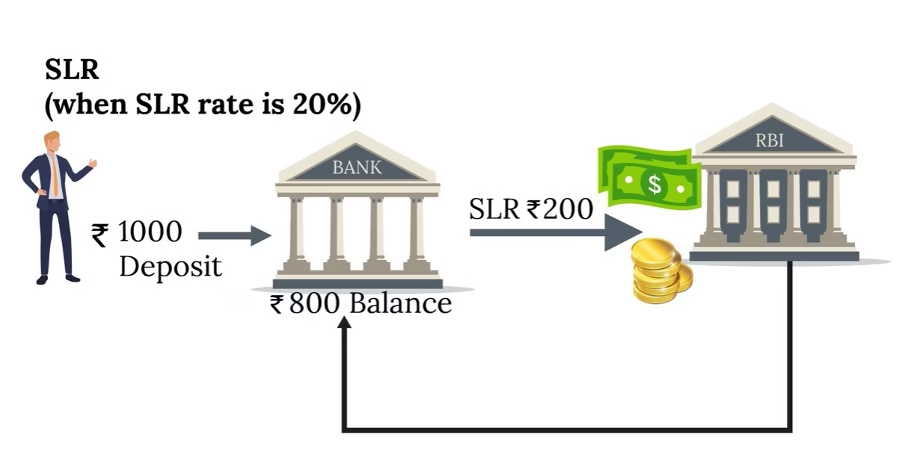

Statutory Liquidity Ratio

All commercial banks (and some other specified institutions) in the country have to keep a given proportion of their NDTL as liquid assets in their own vault. This is called statutory liquidity ratio.

The word statutory here means that it is a legal requirement and liquid asset means assets in the form of cash, gold and approved securities (government securities).The RBI itself gives periodic updates about which assets are qualified as liquid assets under SLR. Similarly, it also gives institution specific guidelines for SLR to be kept.

As the SLR is a statutory requirement and banks prefer to keep their SLR in the form of income earning securities, government can easily sell its bonds to the banks.

This means SLR has facilitated government’s debt management programme. Securities above the SLR limit will be eligible from accommodation (temporary loan) under RBI’s repo.