Different Ways to Transfer Funds Online in India India currently has various methods to transfer money online such as digital wallets, UPI, and more. However, the most commonly used online fund transfer method has been:

- National Electronic Funds Transfer (NEFT)

- Real Time Gross Settlement (RTGS)

- Immediate Mobile Payment Service (IMPS)

While NEFT and RTGS was introduced by RBI (Reserve Bank of India), IMPS was introduced by National Payments Corporation of India (NPCI).

NEFT: National Electronic Funds Transfer (NEFT) is a payment system that facilitates one-to-one funds transfer. Using NEFT, people can electronically transfer money from any bank branch to a person holding an account with any other bank branch, which is participating in the payment system. The NEFT transactions can be carried out in bulk and repetitively.

RTGS: Real Time Gross Settlement (RTGS) is another payment system in which the money is credited in the beneficiary’s account in real time. This fund transfer method is typically used to transfer enormous sum of money.

IMPS: IMPS is an abbreviation for Immediate Mobile Payment Services, which is an instant inter-bank funds transfer system. This funds transfer method is more customer-centric than the other two as it allows the remitter to transfer funds using their smartphones.

NEFT, RTGS and IMPS payment systems were introduced to offer convenience and flexibility to the account holders. To use these online fund transfer services, remitter (person who wants to transfer money) must have the basic bank account details of the beneficiary (person to whom the money is to be transferred).

The bank account details include the beneficiary’s name and bank’s IFSC(Indian Financial System Code). Though all the three payment systems are used for funds transfer, they exhibit a few differences. Before learning their differences, let’s first learn some basic terms revolving around payment systems. These terms will help in understanding the difference among different payment systems better.

Fund Transfer Limit

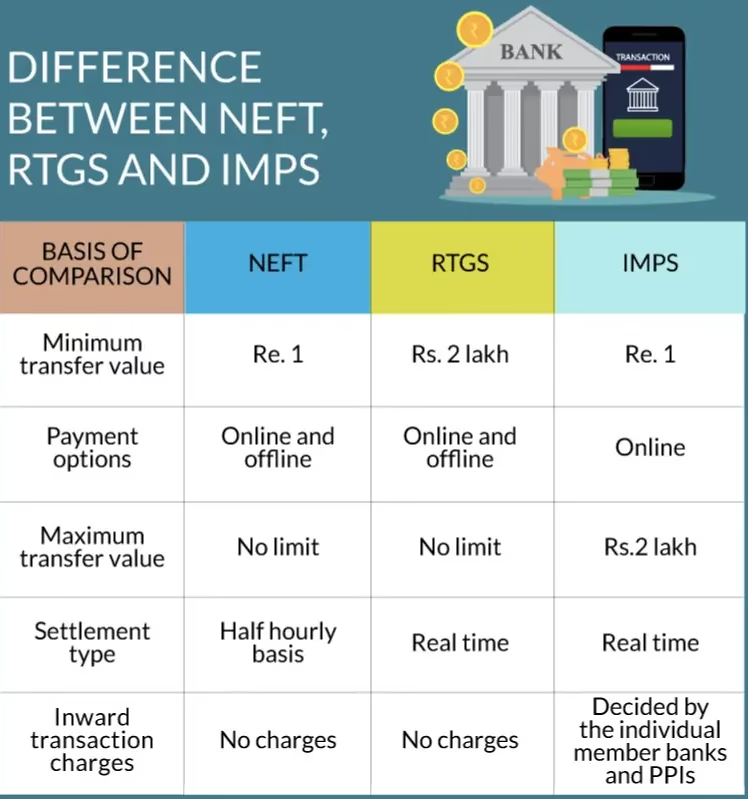

The maximum and minimum amount of money allowed for transfer by each payment system may differ.

Service Availability

Some payment systems are available for 24*7 while others have specific timings. Payment systems that are available 24*7 allow remitters to initiate money transfer anytime and any day. However, the funds will settle only when the service is available.

Fund Settlement Speed

Different fund payment systems have different fund settlement speed. Fund settlement speed here is the total time consumed to settle money from one account to another after the transfer has been initiated.

Fund Transfer Charges

Transferring money involves charges. As per RBI, fund transfer charges for each payment system are decided by banks. The amount charged is based on the amount to be transferred, transfer speed and other features offered by the bank.